Empowering You with Knowledge

Upcoming Events and Workshops

Featured

Retirement Wealth Academy

Are you 55 or older and approaching or already enjoying retirement? This exciting new chapter brings unique financial considerations. Our Retirement Wealth Academy course is designed specifically for individuals like you, providing valuable insights into the critical areas of retirement planning.

We’ll help you navigate these important decisions and build a solid foundation for your financial future.

Upcoming Events

Join Us to Learn, Grow, and Secure Your Financial Future

Stay ahead of the curve with our upcoming events and workshops, designed to provide you with expert advice on all things retirement, financial planning, and wealth management.

Whether you’re just starting to plan for retirement or looking to refine your financial strategy, our events offer valuable insights and practical tools to help you succeed.

Investment Strategies for Retirees

Wednesday, February 26

A deep dive into the best investment options for retirees and strategies to manage market risk.

Maximizing Your Social Security Benefits

Wednesday, February 26

A deep dive into the best investment options for retirees and strategies to manage market risk.

YOUR REGISTRATION INCLUDES

Course Workbook

Optional Personal Consultation

Course:

Retirement Wealth Academy

Learn About Key Financial Topics

Our Retirement Wealth Academy course is designed specifically for those ages 55+ who are either nearing retirement or already retired. This course will provide valuable insights into critical areas of retirement planning, helping you make informed decisions and build a solid foundation for your financial future.

Learn more and register today!

Why Attend?

This interactive course covers 5 key elements crucial for successful retirement planning:

- Income Planning: How to manage your money after retirement and ensure a steady stream of income.

- Investment Strategies: Smart investment choices for retirement savings.

- Tax Efficiency: Minimizing taxes in your retirement years to preserve wealth.

- Risk Management: Identifying and managing risks to your retirement savings.

- Enjoying Retirement: How to structure your finances to enjoy hobbies, travel, and other passions.

Take Control of Your Retirement Planning

What You’ll Learn

In this course, you’ll gain invaluable insights into:

- The Benefits of Converting Your IRA to a Roth IRA

- Identifying the Main Risks to Your Retirement Savings

- Strategizing Your Retirement Income for Comfort and Stability

- Affording and Enjoying Travel, Hobbies, and More in Retirement

Reserve Your Seat Today for These Exclusive Insights!

Course Agenda

Section 1: Pre-Retirement Planning

In today’s world, retirement is different than even when our parents retired and probably will last longer. What are your goals and objectives in retirement and how do you want yours to look like, feel like, and be like? With inflation, rising healthcare costs, and market volatility, many retirees are concerned about their money lasting.

This section will discuss:

- How do we start building for a dream retirement?

- How to live a purposeful and rewarding retirement.

- How socializing and staying active can play a role.

Section 2: Financial Concerns & Issues

Once into retirement, you want to know that your money is going to last and not jeopardize your Florida lifestyle. Find out what has changed and what are the biggest concerns and hurdles for investors. You’ll also learn 6 ways to identify a recession.

This section will discuss:

- Estimate your monthly lifestyle expenses.

- Estimate your monthly income sources from Social Security, pensions, investments, rentals, and other available resources.

- Determine your monthly distributions.

- How to factor in taxes and inflation.

- Understanding the importance of your rate of return.

- How do you properly plan for retirement?

- How legislative risk could impact your retirement.

Section 3: Investment Planning

Your portfolio and its diversification should be determined by prioritizing your goals, objectives, and needs. With proper planning your purpose should determine placement of your investments. This section will discuss your investments and help you determine if they are appropriate for your needs.

This section will discuss:

- Let’s get you reacquainted with your portfolio.

- How to identify the strengths and weaknesses of your portfolio.

- Learn about volatility, risk, inflation, and withdrawals.

- Learn how to create accountability.

- Stocks vs. bonds vs. ETF’s.

- How investment behavior impacts your emotions and decisions.

Section 4: Retirement Income Design

Once you are retired, you are now unemployed, and typically you now have to create your own paycheck. You also have to make sure that it lasts, addresses market volatility, inflation, health care, and so much more. In the section, we’ll go through ways to create income to sustain your Florida lifestyle.

This section will discuss:

- Learn the requirements of an income strategy.

- How to create streams of income.

- Why having an income plan answers a majority of questions.

- Learn about making sustainable monthly withdrawals.

- How to create imperishable income.

- Social Security Strategies & Taxes.

- IRAs, Roth IRAs & Roth IRA Conversion.

- Should you take a lump sum or payment option for your pension?

- Required Minimum Distributions.

- How to create increasing income to offset inflation.

Section 5: Annuities

In this section you’ll learn the good, bad, and the truth about annuities. You have questions; we have answers. Find out if an annuity is either right or wrong for you. Find out if different income strategies that can be built could be a better fit than cash or CD’s.

This section will discuss:

- What is an annuity?

- How could an annuity fit in to your plan?

- Discover the living benefits of some annuities.

- Differences between annuity types.

- How to create your personal pension plan from an annuity.

Start learning today!

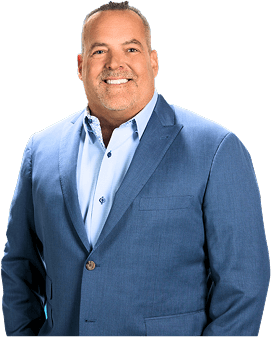

Your Instructor: Eric Kearney

Experienced. Knowledgeable. Dedicated to Your Financial Future.

Your instructor, Eric Kearney, is an Investment Advisory Representative with extensive experience in wealth management and retirement planning. Eric, along with his team at Retirement Wealth Advisors LLC., will guide you through the complexities of financial planning, helping you make informed decisions to secure your retirement.

- Credentials: SEC Registered Investment Advisor

- Expertise: Income and investment strategies for retirees

- Passion: Helping individuals and families achieve financial peace of mind

Meet Your Instructor and Get Started

Eric Kearney

Investment Advisory Representative of Retirement Wealth Advisors LLC

What’s Included with Your Registration?

Everything You Need to Kickstart Your Retirement Planning

When you register for our Retirement Wealth Academy course, you’re not just signing up for a session — you’re investing in your financial future. Your registration includes all the materials and resources you need to make the most of your learning experience:

- Course Workbook: A comprehensive guide filled with practical tools, worksheets, and essential information to support your retirement planning journey.

- Optional Personal Consultation: After the course, you’ll have the opportunity to schedule a one-on-one consultation to discuss your specific financial needs and create a tailored retirement plan.

Ready to Take the First Step?